Twiliner - come on board of Europe's first overnight sleep bus

With Europe's first and only certified and patented reclining seat for buses, Twiliner offers travel comfort for business travelers, expats, and ESG-oriented customers, generating 86% fewer emissions than air travel. For you as an investor, this means the opportunity for above-average returns on investment thanks to the platform model, in contrast to traditional mobility startups, which are usually asset-heavy and low-margin.

- SecuritiesDigital share with voting rights

- Impact> 110,000 fewer tons of CO2eq per year

- AwardsPatent pending

The Pitch

There are hardly any alternatives to flying, and environmentally friendly flying is still decades away.

To keep global warming below 2°C, each person should emit no more than 600 kg of CO₂ per year. But with just a single round trip from Zurich to Barcelona, a passenger already causes 500 kg of CO₂ emissions.

Twiliner closes the gap for flexible, low-CO₂, and comfortable ground mobility thanks to bus travel with lie-flat seats.

We have developed the first and only certified and patented lie-flat seat for buses in Europe, thus achieving true pioneering work. This enables a superior travel experience with 91% fewer emissions compared to flying.

Strong investment opportunity

Attractive risk-return profile through first-mover position

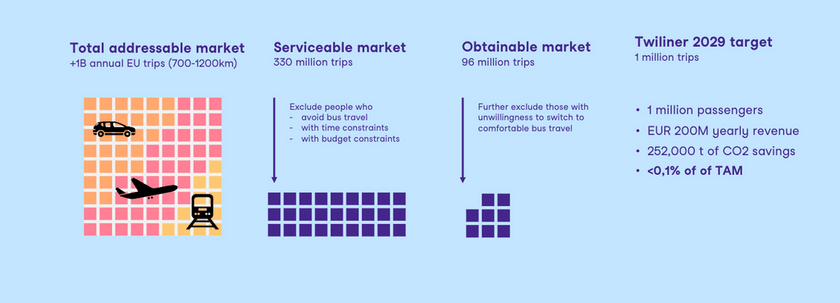

With premium night buses, Twiliner is opening up a completely new market segment and is therefore a first mover in Europe. With the patented (patent pending) seating system, we have built clear IP protection. This gives us a unique selling proposition in a niche that alone in Europe comprises more than 100 million potential annual trips. The barriers to entry for imitators are high — both regulatory (safety approval) and technological (seat development). This way we combine a growth story with risk minimization.

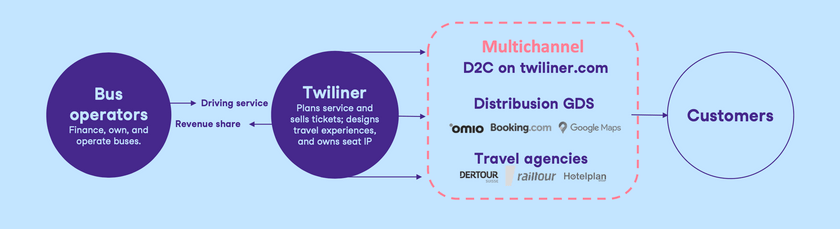

“Asset-light platform model” with strong margin perspective

We do not invest in buses, but in an asset-light platform model: seating system + brand + booking platform. This means: every additional vehicle is financed by partners, Twiliner benefits through licenses and revenue sharing — with minimal Capex. This model enables an EBITDA margin of over 25% once a critical mass of routes is reached. For you as an investor, this means: above-average capital returns compared to classic mobility startups, which are usually asset-heavy and low-margin.

Clear exit path and multiple opportunities

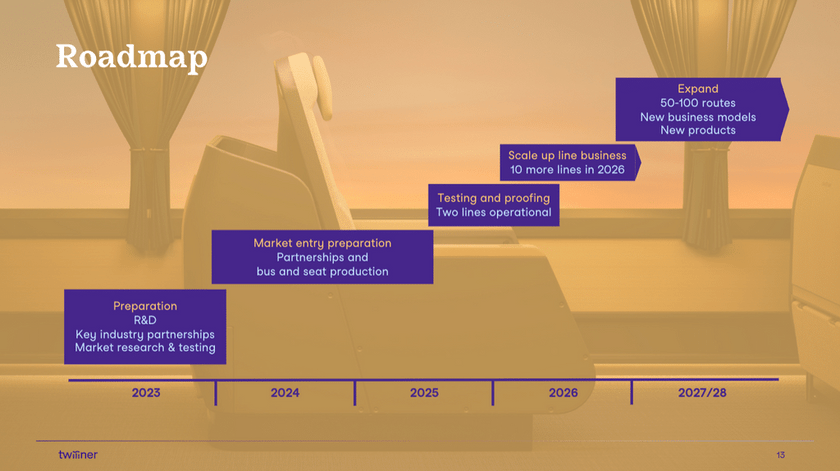

The mobility sector is undergoing strong consolidation: players like FlixBus, Eurolines, or BlaBlaCar are constantly looking for ways to differentiate themselves. An established premium segment with a scalable brand and proven technology is an ideal acquisition candidate. Our goal is to transport around 1 million passengers per year by 2030 and thus reach a revenue volume in the high hundreds of millions. At industry multiples of 2–4x revenue, this corresponds to a potential exit value of >CHF 300 million — i.e. more than 30 times today’s valuation.

Competitive Advantage

Asset-light: Our bus partners cover the investment costs.

Scalable and flexible: We can quickly add new routes and adjust them flexibly.

Demand: We have access to over 250 established distribution channels (e.g. Google Travel, Booking.com) and solutions for business travel.

We can scale and adapt routes quickly according to demand.

Market Potential

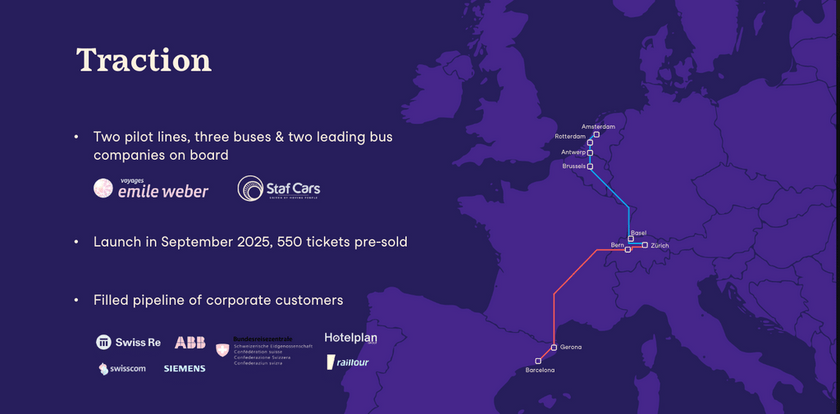

In autumn 2025, we will launch our first two routes (Zurich–Amsterdam and Zurich–Barcelona).

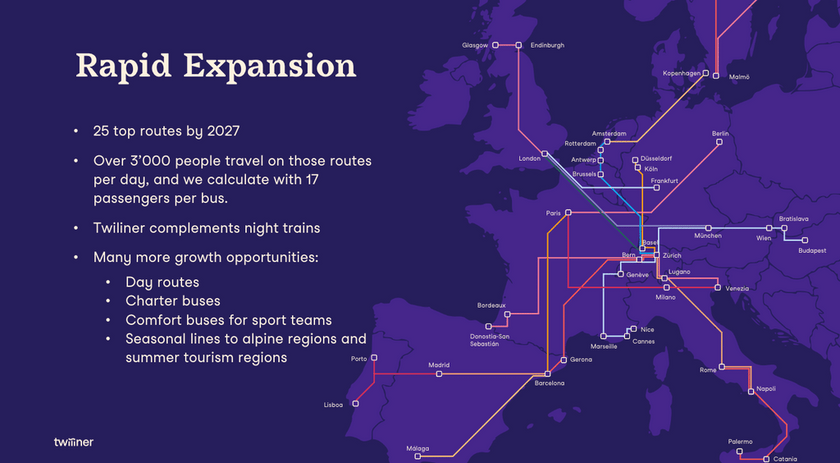

Our goal is to build a regular route network across Europe as soon as possible. Further connections and new bus partnerships are planned.

Capital-efficient and scalable business model

We work with leading bus companies that finance and operate the buses (CAPEX ~€1 million/bus) – in the long term, we will license our patent-pending seating system, our brand, and our digital booking platform to operators across Europe. In this way, we can expand cross-border connections very quickly, adapt our offering to seasonal demand, and implement the model in multiple countries. The more connections we create, the more valuable the Twiliner network becomes. This in turn ensures significantly lower operational risk exposure while simultaneously increasing operating margins considerably.

Revenue sources: Ticket sales (D2C + OTAs), B2B subscriptions, licenses.

Profit distribution: Partners receive fixed costs + ~25% profit share, Twiliner retains the rest. This asset-light model is highly scalable and enables EBITDA margins of >25%.

Negative cash conversion cycle: We pay our bus partners after the trips are completed.

Profitability: We are profitable with 14 passengers and expect an average of 17 passengers.