Why storytelling is the most important skill in fundraising.

The marketing landscape has changed significantly in recent years. Market participants demand real stories, authentic content, and accountability to their values from companies. They care a lot about the values a company stands for and have expectations beyond what they are purchasing.

This shift requires you to rethink your fundraising approach equally – moving from aggressive advertising to value-based marketing.

Your company values will make all the difference.

Value-based marketing means nothing else than aligning your marketing activities and messages with values that match the beliefs and ideas of your target audience. Instead of focusing on product features, value-based marketing aims to build relationships by aligning with your audiences' values and goals. And that's exactly what you need for an successful fundraising. Wondering why?

You don’t get married on the first date.

What applies to romantic relationships also applies to fundraising relationships. They need time, care and shared values.

To attract shareholders for your business growth, you first need to understand what values drive your company in order to identify the target group for which these values are most relevant.

Align you messages with values that match the beliefs and ideas of your target audience.

Understanding your company's purpose forms the basis of your shareholder targets.

Your marketing efforts should align with your brand’s identity and positioning. Do you already know your company’s identity?

Simon Sinek’s «Golden Circle» model helps determine and communicate your company’s identity.

- First, ask why your company exists and what motivated you to start it.

- Next, look at how your company fulfills its mission and the values guiding you.

- Finally, identify what your company offers – the specific products or services.

Simon Sinek developed «The Golden Circle» model based on the belief that successful organizations and leaders differentiate themselves from others by thinking and acting from the inside out. He argues that most people know what they do (the «what»), some know how they do it (the «how»), but few know why they do it (the «why»). Sinek believes that the «why» - the deep motivation or conviction behind a person's or organization's actions - is the most important driver of success. He argues that organizations that can clearly understand and communicate their «why» can build a stronger bond with their customers and employees and shareholder alike.

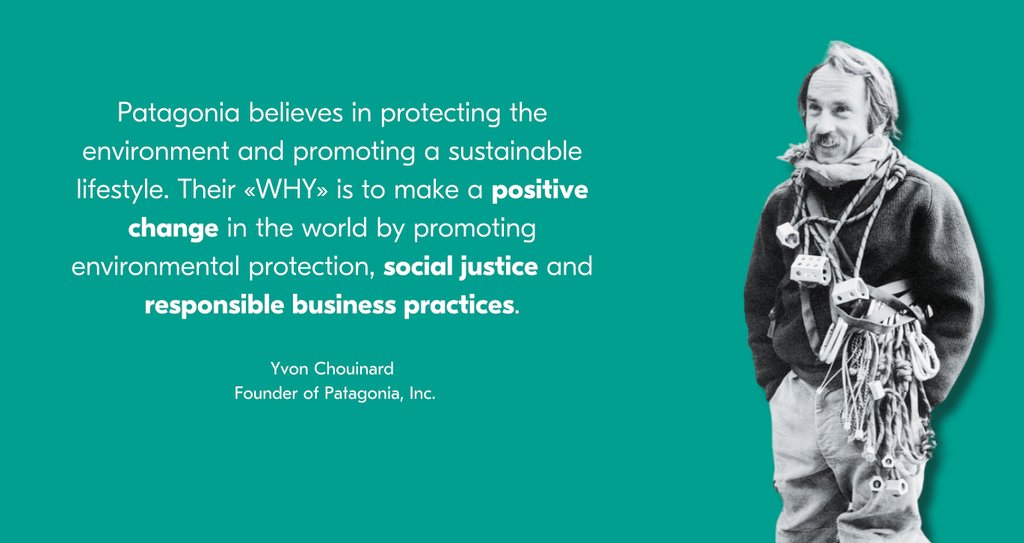

Example Patagonia:

In summary, Patagonia's «Golden Circle» could read as follows:

Why: «We believe in protecting the environment and are committed to a sustainable future.»

How: «By producing high-quality outdoor clothing and equipment that is durable, functional and environmentally friendly, and by promoting environmental protection and social justice.»

What: «We offer a wide range of products and services, including outdoor clothing, backpacks and camping gear, to help people enjoy the outdoors while minimizing their environmental footprint.»

The three key elements of your fundraising strategy

Use this simple framework:

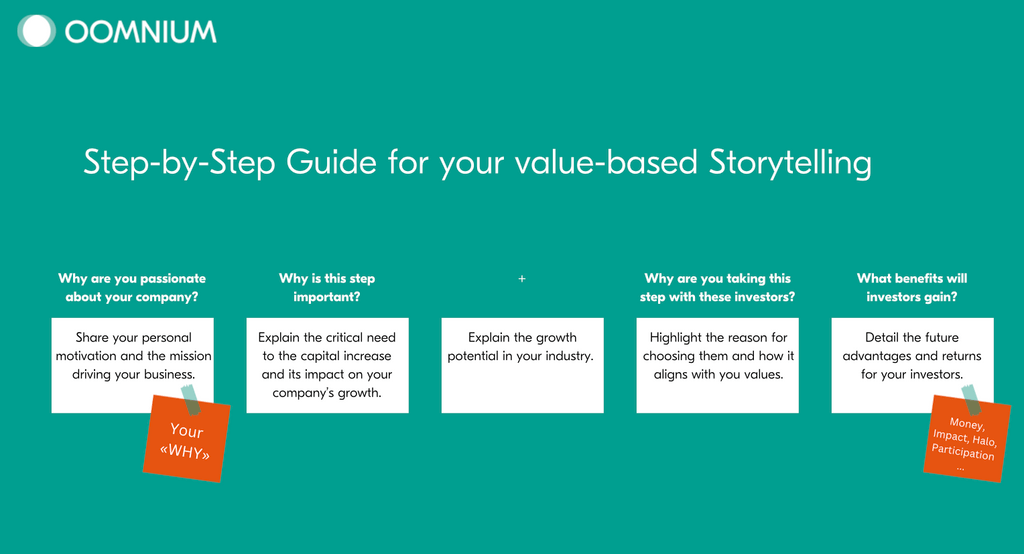

- Now that you understand «why» you do what you do - you get your company's values.

- By understanding «who» this values matters to - you discover your shareholder potential.

- And finally, your storytelling communicates your values to convince your future shareholders.

Emotions play a central role in decision-making. Including financial investments.

You may argue that investors may base their decision on financial potential, but it's your storytelling that makes them even considering it.

Investors like to believe they make rational, data-driven decisions. However, neuroscience tells a different story: emotions play a central role in decision-making, including financial investments: Emotions Drive Decisions, Logic Justifies Them.

Investors might look at numbers, but what makes them act is the emotional connection to you as founder, to your vision, problem, and impact.

Want some examples?

Fear of missing out (FOMO) - If you as a founder convey urgency and momentum, investors don’t want to miss the opportunity.

Trust & Credibility - Investors back founders they feel connected to and trust, often because of the story behind the team.

Hope & Inspiration - Startups that align with personal values (e.g. healthcare innovations that save lives) create a deeper investor connection.

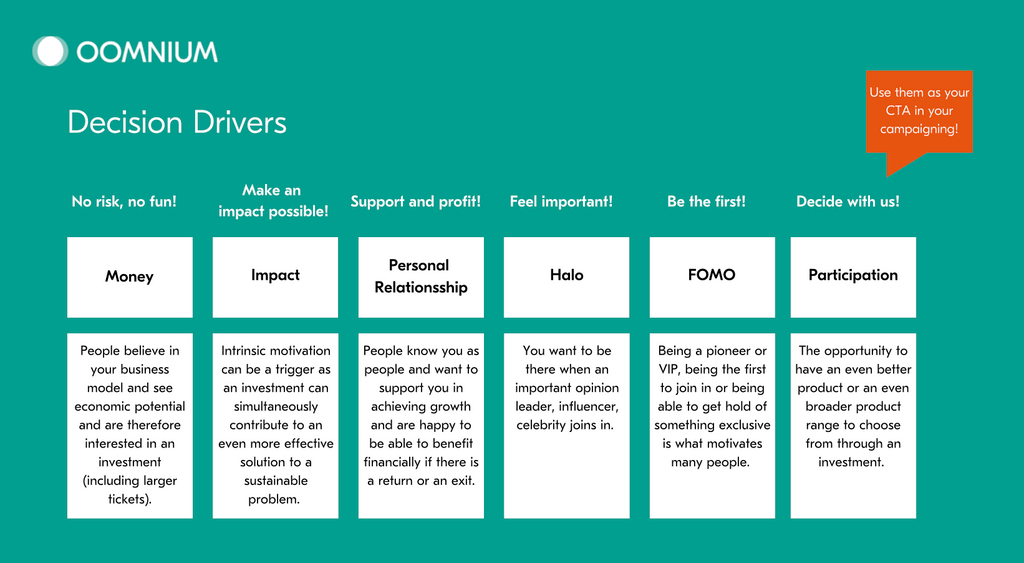

What motivates each of your investors target group to make a move?

Let's now focus on decision drivers by asking yourself what motivates each of your target groups to make a move.

Explore the potential of your case in this regard or decide on alternative triggers:

Now that you understand what values drive your company and understand for which audience these values are most relevant and which decision drivers make them move - you can put it together:

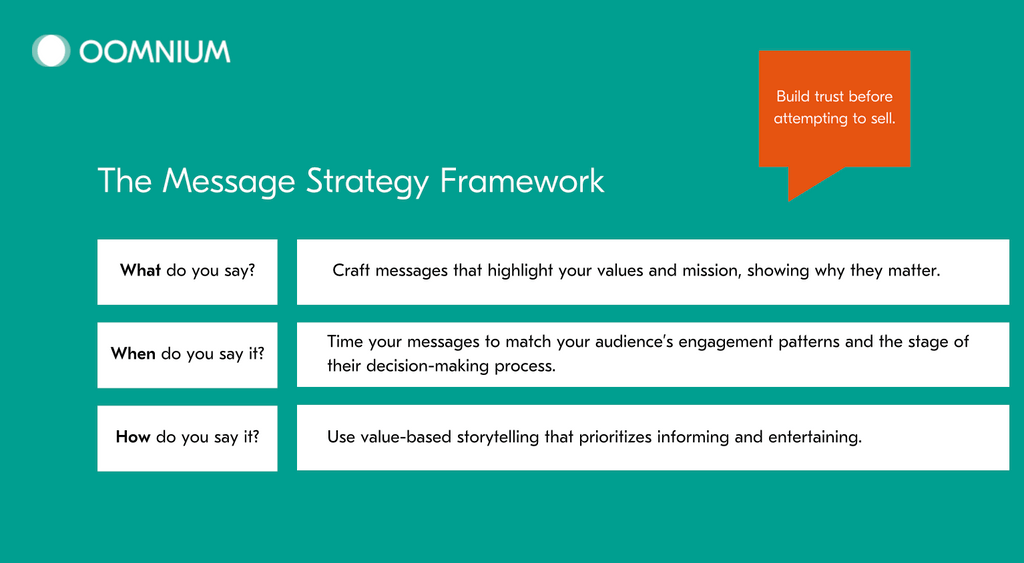

From the Message Strategy Framework to your fundraising storytelling:

Good to know:

Storytelling plays a big part in our daily work, but our offering goes far beyond:

- With OOM we offer you a platform for the execution of your funding round - fully digital.

- Running your funding round on OOM is a complementary way to traditional fundraising - helping you to attract an additional target audience bringing in additional funds.

Questions?

No matter if they are about storytelling, our platform offering or of general fundraising nature - please drop us a line on hello@oomnium.com